How to Handle Your Personal Taxes when You Are Startup Folk

Please note the following:

- This is a U.S. centric post; I don't know how taxes work anywhere but here

- This post assumes that you have an accountant to help you

- This post documents what I personally had to go through on 1/23/17 to get my personal deductions together and I wrote it, honestly, because next year I'll have to go thru the same process and this is the first time since 1987 that I feel good about the process I used.

- I am not an account and you should really talk to your own accountant. This is the process that I have followed for years and since this year I actually did it well, I thought it was worth sharing. Taking tax advice from a stranger on the Internet, well, your mileage may vary (YMMV).

When you fall into that vague category of startup folk – entrepreneurs, founding engineers, etc – organizing your personal taxes is a bloody disaster. I spend money all year long that should generally fall into the category of business deductions. Normally I don't pay all that much attention and just treat it as a loss. This year I've got some additional tax concerns so I actually got serious and really itemized hard. Here's how I did it.

What You Need

Here is what you need:

- Access to every single email account that you used where a receipt might accumulate

- Access to all the online services that don't always send receipts

- File folders

- Paper

- Pen

- Time

- Willpower; this is an incredibly draining process

- A printer

Reminder - Use the gmail and Amazon Print View

When you are printing stuff from gmail you should use the printer icon to get a print view. This renders much better when it is available and uses less paper. There is also a specific print view for Amazon orders that is better than the default.

A Brief Tax Rant

Taxes are my least favorite thing in the whole wide world. I find the U.S. tax code byzantine in its complexity and entirely unfair. As I see it, the core principles of taxation are:

- Everyone should contribute

- Taxes should be understandable by everyone since they are imposed on everyone

- Every dollar should flow through the tax mill once and only once

The U.S. tax code violates every one of these core taxation concepts. Now, that said, it is important to note that while I don't like it, I also believe in being 100% honest and I never want to be audited so the trick here is meticulous documentation. There is nothing wrong with a $2.31 AWS bill being deductible – but you have to document it. That's why #8 above is a printer – I made physical paper copies of every single expense.

Step 1: Create a Physical Artifact For Each Expense Category

Taxes are important because if you screw them up, the tax man can make your life a living hell. My father has been audited, every year, for over a decade. And nothing ever happens to him but, to my mind, that's flying far too close to the sun. And when something is as important as taxes then you handle it with a physical artifact because physical artifacts last.

My first step was to create a representation of each category. In my case that was a single sheet of white printer paper with the category name on it. So I had a stack of pages like this:

- Hardware

- Software

- Office Supplies

- Online Services

- Conferences

Step 2: Write Down What You Remember

The next step is that you want to write down on each representation what you remember as big ticket items. So, for example, I wrote down these:

-

Hardware

- Intel NUC

- MacBook Pro

- Dell Widescreen Monitor

-

Software

- Ruby Motion

-

Conferences

- Elixir Con

I suspect that these few expenses covered maybe 70% of my year. And by writing them down I'm at least guaranteeing that I'll look for them. When you're a member of the startup tribe, well, life is fast paced and it is easy to forget about things.

Step 3: Start with Email

Take your first email account and run a search for the keyword receipt. You might also, if you use gmail, want to look at your purchases label that Google sets up for you. You will find that this process is exhausting because you are likely going to look at hundreds of different emails. As you find each receipt then:

- Print it out

- Put it in the right category

- Add it to a tally sheet or a spreadsheet

Here is the key idea – nothing is too small. If you bought a $10 USB stick and it was actually for business yes, well, then you should deduct it.

You need to do this for every single email account.

Step 4: Access Every Ongoing Online Service

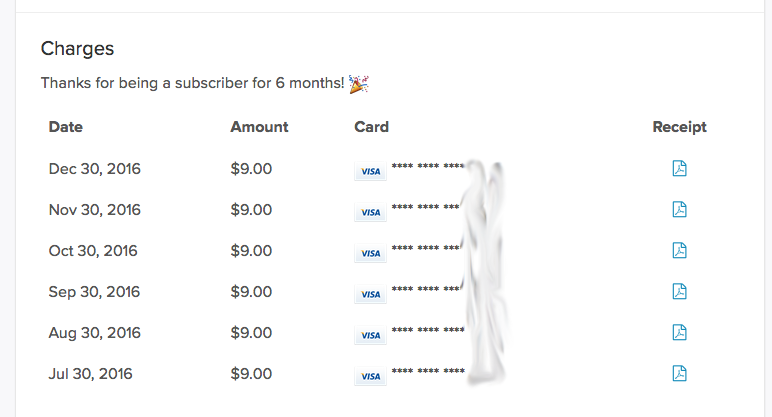

In the era of cloud services, we all have a frightening amount of monthly fees. What you want to do here is log into each one and get a print out of either each receipt or the main receipt index. Here's an example from the outstandingly good GoRails site:

On your Online Services page you want to add a entry for "Go Rails" (or whatever) and then a total ($51) and a date (2016). You need to do this for every single online service.

Step 5: Review Every Single Thing from Amazon

This is the big, hard one. Amazon does a brilliant job of making your order information available to you and that is excellent but you still have to go thru it yourself and remember "Ok that hard drive – was that for my kid's Xbox or is it on my desk?". But, if you are anything like me, you'll find that there are a lot of small business purchases lumped in with your personal purchases.

If you use Amazon a lot then you'll find that you have a large number of orders to sort thru. I had 41 pages of orders to sort through for the year of 2016.

Step 6: AWS

I didn't find many, if any, receipts for AWS in my email so I logged into my AWS console separately and went thru that manually.

Step 7: Think Hard and Iterate Again

The final step here is actually the hardest – you need to think and think hard about what you did over an entire year and what might actually be tax deductible. It is almost certain that you will have forgotten something so think long and hard. If you come up with something then follow the process above.

Step 8: The Result!

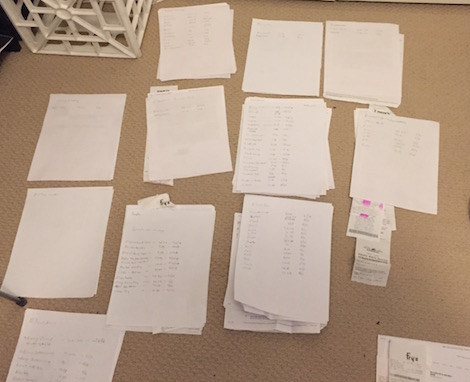

At the end of the process here's what the floor of my office looked like:

All I have to do now is summarize the tally sheet on top and give it to my accountant.